Four Reasons to Get Your Credit Act Together

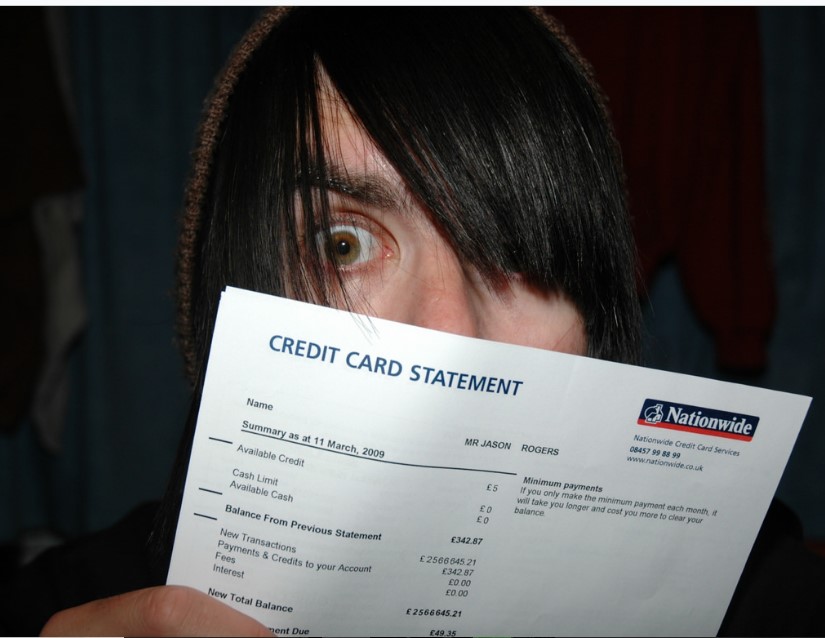

For someone who has a bad credit score, they will drop everything and start reading this article, and for someone who has a good credit score, albeit they don’t actually need to read this article, who knows that your credit score can change for the worse in the future. You should prepare yourself with the necessary knowledge of fixing bad credit. Therefore, let us present you the reasons to get your credit act together:

Get Better Interest Rate

When you have a low credit score, lenders and other financial institutions will be reluctant to give you a good interest rate because they think that it’s risky lending money to you. So, they will charge higher on your credit card balances, so you have to pay them more. This is easily one of the best reasons to fix your credit score because once you do, you can get a better interest rate and save more money.

Get Lower Insurance Rate

Insurance rates are necessary, and some countries have them listed as mandatory to have, which doesn’t give us much of choice. But, if we have a bad credit score, all of our insurances like cars, houses, life will hurt a lot, much worse to our finances, and we have to give up more money. So, we should have better credit scores to save insurance money.

Get a Credit Card

Credit card companies won’t give out credit cards to just about anyone, especially not to someone with a bad credit score and history. However, once we fix our credit score, we can apply for a credit card which will be a huge asset for us in the future to avoid bringing too much cash in our pockets and engage with businesses that don’t accept cash. This is why it is important to get our credit act together and fix our bad credit scores.

Get Higher Credit Limit

Once we fix our credit score, we are allowed a credit card. However, usually, they are put on a low limit, and it will suck for us if we reach our limit too quickly when we have other things to pay for, so what we should do is improve our credit score, and in turn, our creditors will give us higher credit limit that will be a good advantage for us in the future when we want to rent a car or a place.

The Takeaway

There are many excellent reasons to improve our credit score, and we can always do better. We genuinely hope that this article has helped you somehow, and we wish you all the best in your effort to fix your credit score!

A mortgage broker signifies your concerns, not those of a lender. With a wide range of mortgage products to choose from, a broker can offer you the best value in terms of interest rates, payment amounts, and loan solutions. In addition, the mortgage broker will consult with you to determine your short- and long-term needs and goals. Therefore, advanced mortgage plans and complex solutions are the advantages of working with an experienced mortgage broker. In addition, mortgage brokers have access to wholesale mortgage rates. For borrowers with credit problems or minimal fiscal resources, the use of lower rates could mean the difference between an affordable mortgage or not.

A mortgage broker signifies your concerns, not those of a lender. With a wide range of mortgage products to choose from, a broker can offer you the best value in terms of interest rates, payment amounts, and loan solutions. In addition, the mortgage broker will consult with you to determine your short- and long-term needs and goals. Therefore, advanced mortgage plans and complex solutions are the advantages of working with an experienced mortgage broker. In addition, mortgage brokers have access to wholesale mortgage rates. For borrowers with credit problems or minimal fiscal resources, the use of lower rates could mean the difference between an affordable mortgage or not. Using a mortgage broker can also reduce the fees typically charged by the lending company. Borrowers may pay funding or origination fees that the lender assesses. This is not necessarily the case. A mortgage broker can obtain wholesale loans from lenders, offering the best interest rates available in the market, which usually reduces the client’s overall price. A reputable mortgage broker will indicate how you are compensated for their services and detail the total cost of the loan. For most borrowers, the significant advantage of a mortgage broker is that they should be able to get you a better deal on your mortgage than you could find on your own.

Using a mortgage broker can also reduce the fees typically charged by the lending company. Borrowers may pay funding or origination fees that the lender assesses. This is not necessarily the case. A mortgage broker can obtain wholesale loans from lenders, offering the best interest rates available in the market, which usually reduces the client’s overall price. A reputable mortgage broker will indicate how you are compensated for their services and detail the total cost of the loan. For most borrowers, the significant advantage of a mortgage broker is that they should be able to get you a better deal on your mortgage than you could find on your own.

Most people are risk-averse, especially during difficult economic times. Regardless, taking no risk means that you will be sleeping on money that could give you huge returns. You can use penny stock shares as a way of getting over your fear of losing money because they are readily available for the public to buy. The low prices also mean that you can start by investing an amount you are comfortable risking. You also sell them without difficulty in case you want your money back. Take precautions by ensuring that you are buying penny stocks from a reputable company to avoid losses.

Most people are risk-averse, especially during difficult economic times. Regardless, taking no risk means that you will be sleeping on money that could give you huge returns. You can use penny stock shares as a way of getting over your fear of losing money because they are readily available for the public to buy. The low prices also mean that you can start by investing an amount you are comfortable risking. You also sell them without difficulty in case you want your money back. Take precautions by ensuring that you are buying penny stocks from a reputable company to avoid losses. You can buy shares as low as $5 per share. The offer is beneficial to starters and those with less money for investment. The low prices per share also give the investor a chance to spread risk by buying shares from more than one company. Fluctuations in share prices characterize stock markets. Diversifying risk is one of the main principles for successful investors because you will not suffer losses on your investment. Penny stocks already trade at low prices, and they are less hit compared to highly-priced stocks.

You can buy shares as low as $5 per share. The offer is beneficial to starters and those with less money for investment. The low prices per share also give the investor a chance to spread risk by buying shares from more than one company. Fluctuations in share prices characterize stock markets. Diversifying risk is one of the main principles for successful investors because you will not suffer losses on your investment. Penny stocks already trade at low prices, and they are less hit compared to highly-priced stocks.

Often, a small number of traders fall for seemingly lucrative trading schemes, but which have not been well tested and which they are not sure of. Unfortunately, such plans have led the investors to heavy losses. Therefore, it would be good to get familiar with an idea before deciding to use it for trading.

Often, a small number of traders fall for seemingly lucrative trading schemes, but which have not been well tested and which they are not sure of. Unfortunately, such plans have led the investors to heavy losses. Therefore, it would be good to get familiar with an idea before deciding to use it for trading. Once you have bought a coin at a price you deem reasonable and have realized some gains after some time, the big question is, what action to take next? Unfortunately, many newbies have no proper plan or a defined point where they can sell off a portion of their investment for profits. Such investors will cling on to their coin as the market moves to favor them, only to lose all the gains achieved for a period.

Once you have bought a coin at a price you deem reasonable and have realized some gains after some time, the big question is, what action to take next? Unfortunately, many newbies have no proper plan or a defined point where they can sell off a portion of their investment for profits. Such investors will cling on to their coin as the market moves to favor them, only to lose all the gains achieved for a period.

The first and most important thing to know before requesting for a loan from any online lenders is the processing time. If you have an emergency that requires instant cash, making sure you get a platform that can process your loan quicker is a must. Most lenders can take up to twenty-four hours before sending you the money. But excellent lenders take just a few minutes to process a loan.

The first and most important thing to know before requesting for a loan from any online lenders is the processing time. If you have an emergency that requires instant cash, making sure you get a platform that can process your loan quicker is a must. Most lenders can take up to twenty-four hours before sending you the money. But excellent lenders take just a few minutes to process a loan. Money and especially loans are very sensitive, that is why you need to take your time and understand the interest rates. Different online lending companies will be charging different interest rates depending on the amount that you want, and the duration you will take to pay back the requested amount. The more extended the period for repaying, the more the interest rate. It is always good to repay your loans on time to increase your credit limit.

Money and especially loans are very sensitive, that is why you need to take your time and understand the interest rates. Different online lending companies will be charging different interest rates depending on the amount that you want, and the duration you will take to pay back the requested amount. The more extended the period for repaying, the more the interest rate. It is always good to repay your loans on time to increase your credit limit.